Investing in Tesla stock has become more popular than ever, and it’s not just for Wall Street elites anymore. Whether you’re a tech enthusiast, an eco-conscious investor, or simply someone looking to diversify your portfolio, Tesla offers a unique opportunity to own a piece of one of the most innovative companies in the world. But where do you start? Let’s break it down step by step so you can confidently dip your toes into the stock market waters.

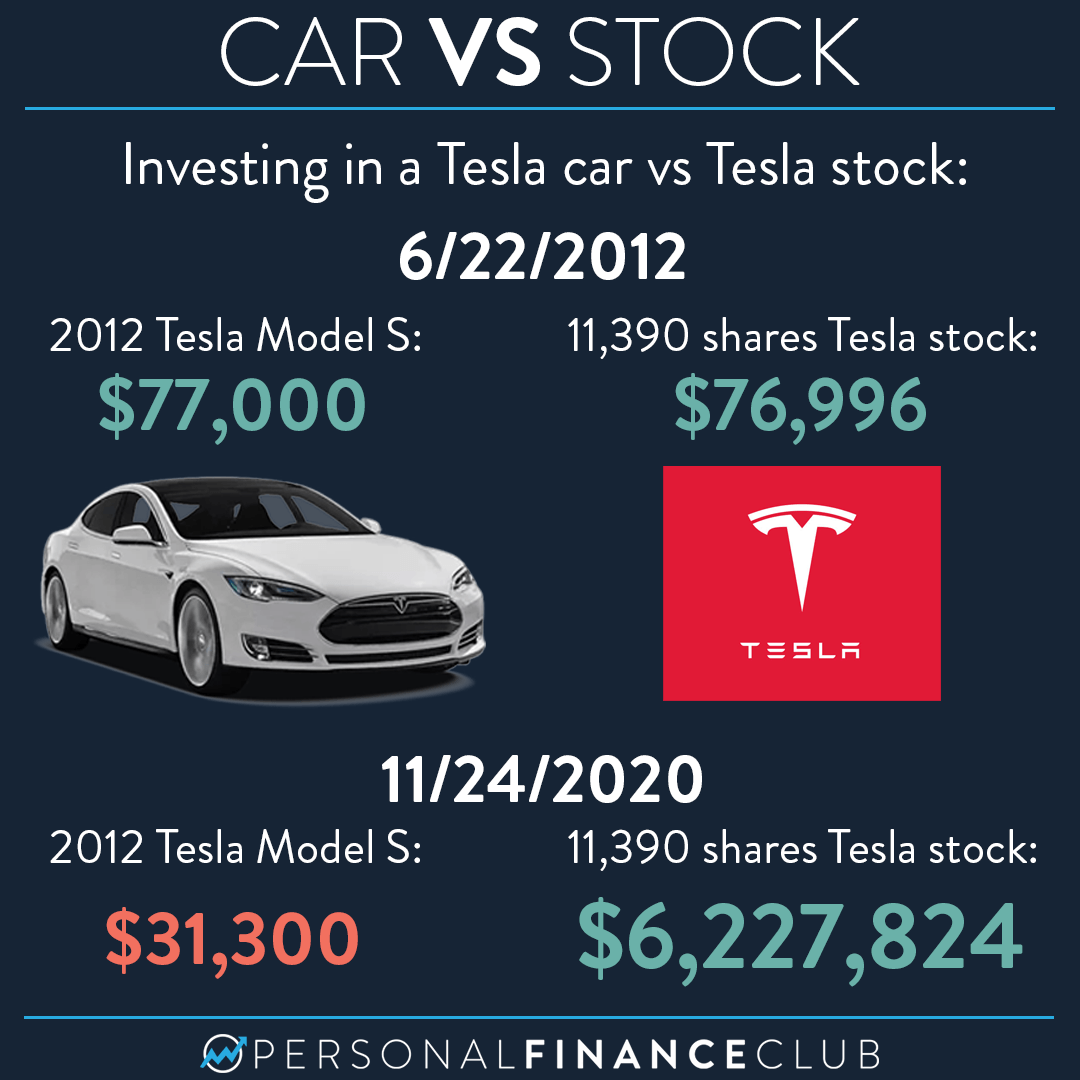

You’ve probably heard about Tesla, right? The electric car giant that’s making waves not just in the automotive industry but across the global economy. Elon Musk’s brainchild is more than just a car company—it’s a symbol of innovation, sustainability, and futuristic thinking. And with its stock price skyrocketing over the years, it’s no wonder people are lining up to get a slice of the Tesla pie.

But hold up, before you hit the "buy" button, there’s a lot to consider. Buying Tesla stock isn’t as simple as walking into a store and picking up a share off the shelf. You need to understand the basics, know the risks, and have a solid plan in place. This guide will walk you through everything you need to know about how to buy Tesla stock—from choosing the right brokerage to understanding what makes Tesla such a hot investment.

Read also:Unveiling The Secrets Of Ccedilrdquodegaumlcedilshyccediloeligyumlaringfrac14ldquo Your Ultimate Guide

Why Should You Invest in Tesla Stock?

Tesla isn’t just another company; it’s a game-changer. From electric vehicles (EVs) to solar energy solutions and even autonomous driving technology, Tesla is at the forefront of multiple industries. But why should you care? Here’s the deal:

- Tesla is leading the EV revolution, and with global demand for electric cars growing exponentially, the company is well-positioned to dominate the market.

- Its innovative approach to renewable energy solutions, like solar panels and Powerwall batteries, adds another layer of potential profitability.

- Elon Musk’s visionary leadership and the company’s commitment to cutting-edge technology make Tesla a favorite among forward-thinking investors.

So, if you’re looking for a stock that’s not just about short-term gains but also aligns with long-term trends in technology and sustainability, Tesla might just be the ticket.

Understanding Tesla Stock: What Are You Actually Buying?

When you buy Tesla stock, you’re essentially purchasing a tiny ownership stake in the company. Think of it like buying a small piece of the Tesla empire. But here’s the kicker: owning Tesla stock doesn’t mean you get a free Model 3 or a discount on solar panels. What it does mean is that you have the potential to profit if the company’s value increases—or lose money if things go south.

Tesla stock is traded on the NASDAQ under the ticker symbol TSLA. It’s been a rollercoaster ride for TSLA investors, with rapid price fluctuations driven by everything from quarterly earnings reports to Elon Musk’s tweets. But don’t let that scare you off; volatility can sometimes lead to big opportunities for savvy investors.

How to Buy Tesla Stock: Step-by-Step Guide

Alright, let’s get down to business. Buying Tesla stock isn’t rocket science (well, not exactly), but there are a few steps you need to follow. Here’s how you can do it:

Step 1: Choose the Right Brokerage

The first step in buying Tesla stock is finding a brokerage that suits your needs. There are tons of options out there, from traditional brokers to online platforms, so it’s important to do your homework. Some popular choices include:

Read also:Themaryburke3 The Untold Story Of A Rising Star

- Robinhood: Great for beginners, no fees on stock trades, but limited features.

- Charles Schwab: Offers a robust platform with plenty of research tools and no trading fees.

- E*TRADE: Known for its user-friendly interface and educational resources.

When choosing a brokerage, consider factors like fees, ease of use, and the level of customer support they offer. Trust us, you don’t want to get stuck with a broker that charges exorbitant fees or has terrible customer service.

Step 2: Open a Brokerage Account

Once you’ve picked your brokerage, it’s time to open an account. This usually involves providing some basic info, like your Social Security number, employment details, and investment goals. Don’t worry, it’s a pretty straightforward process. Most brokerages will verify your identity and set up your account within a few days.

Pro tip: If you’re planning to invest a significant amount of money, consider opening a taxable brokerage account or an IRA (Individual Retirement Account) to take advantage of tax benefits.

Step 3: Fund Your Account

Now that your account is all set up, it’s time to add some funds. Most brokerages allow you to transfer money directly from your bank account. Just link your bank account, initiate a transfer, and voila—you’re ready to start investing.

One thing to keep in mind: some brokerages may have minimum deposit requirements, so make sure you check those before funding your account.

Step 4: Place Your Order

Finally, the moment of truth! Once your account is funded, you can start placing orders. Here’s how:

- Search for Tesla stock using the ticker symbol TSLA.

- Decide how many shares you want to buy. Don’t worry if you can’t afford a full share—many brokerages offer fractional shares, allowing you to invest smaller amounts.

- Choose the type of order you want to place. A market order will buy the stock at the current price, while a limit order lets you set a maximum price you’re willing to pay.

- Review your order details and hit “buy.” Congratulations, you’re now a Tesla shareholder!

Key Considerations Before Buying Tesla Stock

Before you jump headfirst into the world of Tesla stock, there are a few things you should keep in mind:

1. Understand the Risks

Investing in Tesla stock comes with risks, just like any other investment. The stock price can be volatile, influenced by factors like market sentiment, regulatory changes, and even Elon Musk’s social media activity. It’s important to have a solid understanding of these risks before you invest.

2. Diversify Your Portfolio

Putting all your eggs in one basket is rarely a good idea. While Tesla might seem like a surefire winner, it’s always wise to diversify your portfolio across different asset classes and sectors. This helps mitigate risk and increases your chances of long-term success.

3. Stay Informed

The stock market is constantly evolving, and staying informed is key to making smart investment decisions. Follow Tesla’s quarterly earnings reports, keep an eye on industry trends, and pay attention to any major announcements from the company.

How Much Does Tesla Stock Cost?

As of late 2023, Tesla stock trades at around $250 per share, depending on market conditions. However, prices can fluctuate significantly, so it’s always a good idea to check the latest figures before making a purchase. If the price seems a bit steep, remember that many brokerages offer fractional shares, allowing you to invest smaller amounts without buying a full share.

What Affects Tesla Stock Prices?

Tesla stock prices are influenced by a variety of factors, including:

- Company Performance: Quarterly earnings reports, production numbers, and sales figures can all impact the stock price.

- Market Sentiment: Investor confidence and overall market trends play a big role in determining Tesla’s stock value.

- Regulatory Changes: Policies related to electric vehicles and renewable energy can affect Tesla’s bottom line.

- Elon Musk’s Influence: Love him or hate him, Elon Musk’s words and actions often have a direct impact on Tesla’s stock price.

Should You Buy Tesla Stock?

Ultimately, whether or not you should buy Tesla stock depends on your individual financial goals and risk tolerance. If you’re bullish on the future of electric vehicles and renewable energy, and you’re comfortable with the inherent risks of stock market investing, then Tesla could be a great addition to your portfolio.

But remember, investing is not a get-rich-quick scheme. It requires patience, discipline, and a willingness to ride out the ups and downs of the market. If you’re new to investing, consider starting small and gradually building up your knowledge and experience.

Alternative Ways to Invest in Tesla

Buying Tesla stock isn’t the only way to invest in the company. Here are a few alternatives to consider:

1. Tesla Bonds

Tesla occasionally issues corporate bonds, which allow investors to lend money to the company in exchange for regular interest payments. Bonds are generally considered less risky than stocks, but they also offer lower potential returns.

2. ETFs and Mutual Funds

If you prefer a more diversified approach, consider investing in exchange-traded funds (ETFs) or mutual funds that include Tesla as part of their portfolio. This allows you to gain exposure to Tesla while spreading your risk across multiple companies.

3. Options Trading

For more experienced investors, options trading offers a way to speculate on Tesla’s stock price movements without actually owning the stock. However, options trading can be complex and carries significant risks, so it’s not recommended for beginners.

Conclusion: Take the Leap and Start Investing

Buying Tesla stock can be an exciting and potentially rewarding experience, but it’s important to approach it with the right mindset and knowledge. By following the steps outlined in this guide, you’ll be well on your way to becoming a confident Tesla investor.

So, what are you waiting for? Take the first step today and start building your Tesla portfolio. And don’t forget to share your thoughts and experiences in the comments below. Happy investing, and may the stock market gods be with you!

Table of Contents

- Why Should You Invest in Tesla Stock?

- Understanding Tesla Stock: What Are You Actually Buying?

- How to Buy Tesla Stock: Step-by-Step Guide

- Key Considerations Before Buying Tesla Stock

- How Much Does Tesla Stock Cost?

- Should You Buy Tesla Stock?

- Alternative Ways to Invest in Tesla

- Conclusion: Take the Leap and Start Investing